The market on Thursday officially entered correction territory with the COVID-19 coronavirus outbreak spreading global panic and anxiety for financial markets - when it dipped 10 percent below its high. Although this was the sharpest slide since the financial crisis — and the largest one-day point loss for the benchmark Dow Jones Industrial Average in history — market experts and wealth managers say the first thing investors should do is take a deep breath. We agree. We knew you’d like to hear from us!

You learn a thing or two after 25 years in the investment industry after witnessing many market crashes, the gold crash, the end of Bre-X, Nortel, tech dot-com bubble, the bird flu, 9-11, the sub prime and global financial crisis, the polarizing political climate, the oil crash in Canada, amongst many market corrections to boot.

Many of the market corrections/crashes being so painful, and so emotionally distressing. Similar, to what some of you might feel right now. We understand its scary to hear what they say on the news everyday. Certainly, a pandemic again, out of China, seems really scary that not only can you be very sick, but also lose your money, certainly adds a new level of emotion to it. What I can tell you is that the biggest opportunities have come from fallen markets, and people who understand that it will get worse before it gets better, but it gets better and looks for the opportunity, profits. The markets hate uncertainty. There is little knowledge on how far it will spread. How many people will die before a vaccine is created or it settles down? Will it be communicable outside or morph into something related? What is the effect of production shutdowns? What happens with travel restrictions and people not going out? It has created a lot of uncertainty. It certainly has intensified a potential for a global economic slowdown.

The problem with humans and emotion with this sell off is that feeling like you need to sell, is its easy, it’s a knee-jerk, that gives you a feeling of feeling better that you didn’t lose it all, and is emotional. Exactly what is happening with the markets. Part because of the disease. Part of worries of a recession and global economic slowdown, part of worldwide political environments and inaction, and truly because markets were overvalued to begin with. Its also the same emotion that makes you think you can get back in at the exact right time, that often makes people not invest for fear of catching a falling knife. Professional money managers are responsible for performance and don’t react, they do start buying on the way down and up, bit by bit to take advantage of opportunities available. My biggest regret and that of many of our clients, is that they wished they had more money to invest when things like this happened. We have never heard that I or anyone wished they panicked a whole lot more.

The biggest challenge in this industry, and in many things in life, is people’s biggest financial mistake is being too emotional and letting that guide their life, instead of thinking straight. Whether that’s spending or investing. Haven’t you ever heard yourself saying, “I worked so hard I deserve it?” or “I need a break!” or “I deserve those shoes or suits!” “I love this its so cute!” “ I’m scared I won’t get another job, I have to save money”…….while you’re out travelling because you need the break and skiing because you can and because “when you start working you cant do this.” Again, none of these things are often planned, and all of this sounds illogical when its on paper doesn’t it? Everyone is guilty of their irrational justifications based on emotion.

Remember where you were when the planes flew into the world trade center? That’s etched in many people’s memories. Life was never going to be the same. For some things it wasn’t, like TSA security at the airport. However, life carried on. The time at Bre-X. I was TD at the time, Who could imagine their geologist thrown out of a helicopter and it was all for not, painted gold metal??!! It was so shocking for the gold industry and many miners participated, crashing the industry. It seemed life ending, it was for some. People jumped off buildings in Calgary because they mortgaged their homes to get into this hot stock. Then bird flu. A possible worldwide scary pandemic. Then who can forget sub prime crisis? Banks failing. Oh my god is my money safe? We had people asking if they should pull at their money out their banks and keep at home or put with the investment firms and insurance companies if banks were failing.

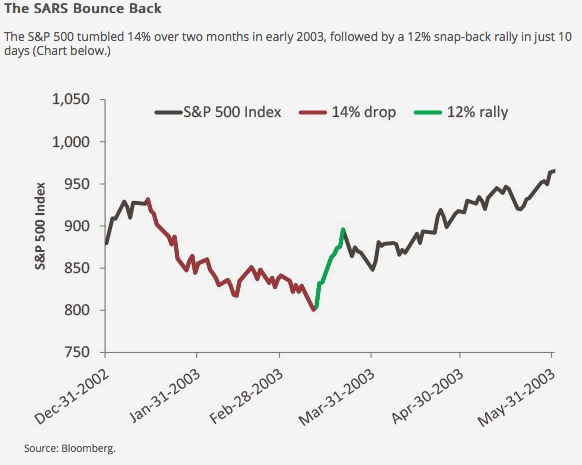

Economists have only a few instances in recent decades upon which to project the economic and market impact of the epidemic such as the SARS outbreak in 2003 and the MERS outbreak of 2012. However, it is worth noting that China's contribution to global growth today is several times larger what it was in 2003. Global supply chains have become much more integrated over the last 17 years, as well, amplifying the potential economic impact of the outbreak.

Assessing the market with long term lens. From a portfolio perspective, it is difficult to determine precise exposure to the outbreak with any degree of certainty in the short term. There has been a flight in income and bonds and safety type investments have pushed those up. Sources of direct risk will include individual companies such as those with exposure to Chinese consumption, significant supply chains running through China, and exposure to energy prices. Indirect exposure will include stocks whose businesses are indirectly affected by what is expected to be a slowdown to global growth.

Again, after the largest almost 12 year run in the markets, we have been clearly saying this run isn’t realistic and the markets will pull back. Check your risk tolerance and don’t be greedy wanting more upside. There is lots going on in the world. Could be many things, or it could be debt, inflation, US elections. Everyone who has been in frequently in the last year, and even two has heard this rhetoric from us. Everyone who has consistently met with us know that tactically, over the past 12-15 months we have been “de-risking” portfolios in those meetings. Meaning, we’ve reduced equity exposure. We have offered different investment platforms. We’ve kept cash on the sidelines and added more diversification and yield investments that offer better risk/reward. Our goal-protecting your portfolio on the downside.

Markets don’t go up forever. Nor do they stay down forever. We certainly know its hard when they go down. Its hard to sit and watch gains wash away. It creates a feeling of regret. Just like one of the fund managers at EdgePoint, global equities manager, wrote in a note this week, “there are very few things in life as uncomfortable as watching the price of something you own go down if you don’t know what the value of it is. Most people don’t know the value of what they own, so dread sets in.” GLC managers also stated “We expect that markets won’t stabilize until fear and the number of new cases has peaked. This does not mean that equities will remain in a free-fall throughout the crisis, simply that volatility will remain elevated. Once signs of improvement emerge a “relief rally” can ensue (here it’s important to note that improvement does not require any sort of “all-clear” declaration, just news of “less-bad” data.)

For those of you who attended our retirement session, you’ll know that people nearing retirement or retirees, the math does change a little. This will be a time when you want to pull out less of your retirement principle. That’s because of the negative sequence of returns principle, which means that people who have to cash in stocks when the market is falling wind up having to sell more shares to net the same distribution value — so when the stock market recovers that person will have fewer shares available to make up their losses. So maybe we then pull from other retirement asset buckets and why its important that you have more than 3-4 different asset buckets, like cash value PAR in insurance and guaranteed income products. It will make you feel a lot more comfortable going through these times. Something we work on implementing with everyone. Times like these help people understand how all these pieces work as a puzzle. We will likely be reaching out more to this group on options to look at.

We will say its still soon to come to a full conclusion on this. However, we can never say it enough, Thank you for the trust you place in us in looking after you and your family, your financial plan and everything financial! Thank you for being excellent clients that come in for your regular meetings. This is WHY we do that and WHY we always take a strategy to diversify over time and protect your portfolio.

We are always there to answer your questions as you need it and will continue to keep you informed!

Pam Lavers and The Tower Group Team!

Investing

Taxes

Estate Planning

Planning for the Unexpected

Kids & Parents

Spending & Debt Management